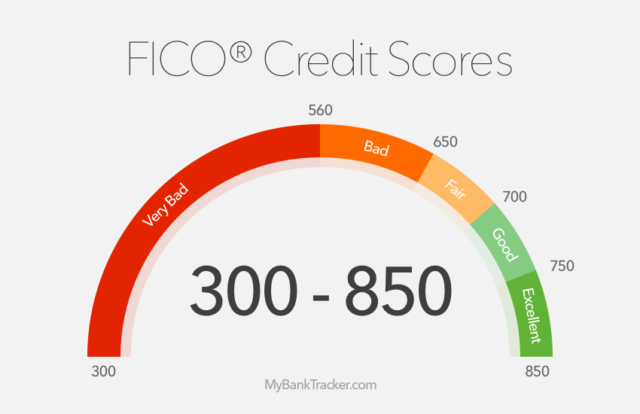

The 5 Categories that Make up Your FICO Credit Score

FICO credit scores are comprised of five categories different categories. Keeping these in mind can help you work toward a higher credit score.

- Payment history: Paying your bills on time is the surest way to keep your credit score high.

- Amounts owed: This actually isn’t the amount of debt you owe, but rather how much debt you owe relative to your available credit or original loan balances.

- Length of credit history: Multiple pieces are taken into account here, including the age of your oldest account, average age of your credit accounts, and ages of individual accounts.

- Mix of credit accounts: A mixture of different loans and debt obligations makes your credit score look healthier.

- New credit: This takes into account how often you’ve applied for credit within the prior year as well as any accounts that are considered “new.”

Image via MyBankTracker.